| How Bear Market Rallies Work By Colin Symons | August 8, 2022

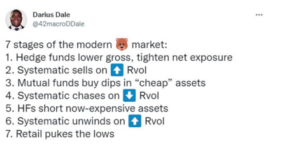

A while ago, I said bear markets hurt everyone. Obviously, bulls get hurt, but so do bears. I think we’ve been seeing that bear pain playing out over the last month or so. In general, how do bear market rallies work? Honestly, I don’t think I can put it much better than Darius Dale of 42Macro:

For what it’s worth, as of the weekend, Darius believes we are in Stage 4, which seems reasonable. Just to explain some details, so I don’t lose anyone, ‘Systematic’ refers to people investing in a system, which is generally based on trends and/or volatility. ‘Rvol’ refers to Realized Volatility, which is the actual volatility we’ve seen over a trailing period. Next, we should expect to see Stage 4 finish playing out and Stage 5 start. Put differently, it’s just a question of where, exactly, this move ends. That’s a really tough call, of course. This bear market humbled a lot of bulls, and now it’s humbled a lot of bears. According to Bloomberg and The Washington Service, insiders have been selling at a good clip, and historically they do well at foreshadowing market direction. If you’re curious as to who’s buying the shares they’re selling, Vanda Research, Goldman Sachs, and Susquehanna say retail investors have come back to buying the market. In a contest between insiders and retail, who would you look to for direction? Again, though, bear market bounces can be brutal. In the tech implosion of 2000, while the market peaked in March, there was a vicious sorting process in the following six months. Poor business models disappeared quickly, but more substantial companies were often bid up based on still-hopeful prospects. For instance, Cisco crashed on the tech destruction but quickly bounced as investors decided they could manage fine. I chose a very long-term chart, below, for context. The red arrow is the aftermath of the tech wreck, between April and October 2000.

Try getting every move just right. Sell Cisco in March, buy it a month later, sell it again in October. Bear market bounces are brutal, and there was a great deal of pain for bears between April and October. Over the broader sweep of history, it’s a blip, but that’s what we’re living through, now. For instance, what is Tesla worth, really? There’s going to be a fight about that, and there will be weeks or months where one side or the other looks really dumb. My point is that day-to-day, week-to-week, even month-to-month, a bear market rally’s job is to chew you up and spit you out. Then, when enough people have given up and conditions clear, no one believes it’s over, and you can potentially make generational wealth if you still have money and brains available. That’s what we’re dealing with, here. Everyone gets to question reality at some point in this process. It’s best to have a process of your own to deal with it, or you too can get chewed up and spit back out by this monster. Colin Symons

Strategic Wealth Partners

Senior Portfolio Manager & Research Analyst

Colin@swpconnect.com Want to view more posts? Click here. Disclosure – Strategic Wealth Partners, Ltd. (SWP) is an SEC registered investment advisor. Investments involve risk and unless otherwise stated are not guaranteed. SWP does not affect or attempt to affect transactions in securities, or the rendering of personalized investment advice or service for compensation. Although the information provided to you is obtained or compiled from sources we believe to be reliable, SWP cannot guarantee the accuracy, validity, timeliness, or completeness of any information or data made available for any particular purpose. The information contained is based on information available at the time. Past performance does not guarantee future results. | |

Enter your information below, and we will email you our new eBook, Tilting the Odds

Enter your information below, and we will email you our new eBook, Tilting the Odds